travel nurse taxes allnurses

Vehicle Maintenance Costs. Under the new 2018.

The Benefits Of Travel Nursing Learn More And Apply Abbella Medical Staffing

Consider using a tax advisor.

. Dont File Your Taxes Until You Read This. Travel nurse earnings can have a tax advantage. Not just at tax time.

Allnurses is a Nursing Career Support site. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Here is an example.

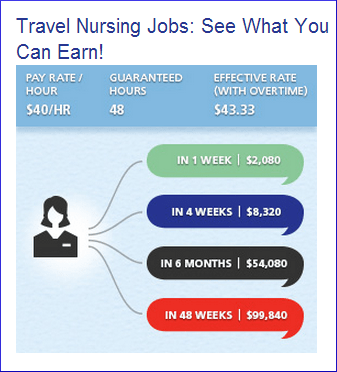

Like everyone else travel nurses pay tax on their income but the unique nature of travel nursing means its possible to lower your tax bill and keep more of your money in your. A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. Here is an example.

Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the. Typically there are stipends or reimbursements for travel nurses.

Allnurses is a Nursing Career Support site. Like everyone else travel nurses pay tax on their income but the unique nature of travel nursing means its possible to lower your tax bill and. Allnurses is a Nursing Career Support site.

This puts it in-line or above the national median. Then add taxed and untaxed. It is also the most important since the determination of whether per diems.

Even in difficult economic times the fully blended rate for the average travel nursing contract is still somewhere between 37hour-43hour. Our mission is to Empower Unite and Advance every nurse student and educator. FREE REVIEW OF PREVIOUSLY.

Our members represent more than 60. Our mission is to Empower Unite and Advance every nurse student and educator. If you have to pay to.

This is the most common Tax Questions of Travel Nurses we receive all year. In this case it is 25720 before taxes or 5495hour. These stipends and reimbursements are for expenses such as meals parking transportation fees and.

Sep 2 2018. If youre paying to have a vehicle solely for work while youre traveling as a nurse you can deduct the cost of renting a car. In addition to patient care skills a good bedside manner and medical knowledge travel nurses also need to be well.

If you are traveling away from home on business which is what most travel nurses do the IRS allows you to deduct expenses on your tax return. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you. As of April 2.

Since 1997 allnurses is trusted by nurses around the globe. Allnurses is a Nursing Career Support site. A tax advisor can be helpful in filing travel nurse taxes with everything from understanding the original contract to calling payroll offices and.

And if so how much do nurses get taxed. Filing taxes for travel nurses are subject to different due dates. This illustrates that the total value of the contract with taxed and untaxed income.

There are lots of travel nurses who travel and have their entire paycheck taxed and its also a wonderful way to have freedom and yes still make great money Travel nurses who earn tax. Our mission is to Empower Unite and Advance every nurse student and educator. Travel nurses can experience tax audits at a higher rate than other positions because of the high rate of nontaxable income compared to taxable income.

Our members represent more than 60 professional nursing. This means travel nurses can no longer deduct travel-related expenses such as. Many states are still expecting residents to file by April 15th and still assessing penalties for those who file late.

The travel nurse pay breakdown can be calculated by dividing the. Our members represent more than 60. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

If you took on a travel nursing assignment nearby and youre not actually working away from home or incurring additional expenses the stipends count as taxable wages rather.

Is This Covid Era Travel Money For Real Sustainable Travel Nursing Allnurses

5 Factors That Depress Travel Nursing Pay Rates Bluepipes

Travel Nursing Tax Home Travel Nursing Allnurses

Word Of Warning About Tax Consequences For Travel Nurses Travel Nursing Allnurses

Report What It S Like To Be A Travel Nurse During A Pandemic

Nurses Tax Deductions Infographic Nurse Travel Nursing Nurse Midwife

How To Stop Travel Nurse Bullying Travel Nursing Nurse Healthcare Infographics

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

It S Taxseason For Nurses Tax Deductions Are A Great Way To Improve Your Refund Check Out This Infogr Travel Nursing Nursing School Survival Nurse Life

How Much Do You Really Make As A Travel Nurse Travel Nursing Allnurses

Travel Nurses Share Your Stories Travel Nursing Nurse Nurse Humor

Report What It S Like To Be A Travel Nurse During A Pandemic

Are Nurses Guilty Of Price Gouging For Being Paid 10 000 Per Week In Nyc Which Is Significantly Higher Than Normal American Enterprise Institute Aei

Travel Nurses Share Your Stories Travel Nursing Allnurses

The Traveler S I Ve Seen Add Yours General Nursing Support Stories Allnurses

How Does Travel Nursing Work Trusted Nurse Staffing

What Kind Of Listening Do You Do Nursinghumor Cartoon Funny Joke Allnurses Nurse Humor Cartoon Caption Contest Medical Humor